The top 30 M&E contractors delivered a strong year of growth last year, collectively raising revenue by 27% to £6.3bn.

Figures collected by consultant GHCS and sector trade body BESA reveal a sector quietly transforming itself to withstand volatility through smarter business models, niche markets, and a shift away from traditional construction practices.

| Top 30 M&E contractors by turnover – (£m) | ||||

|---|---|---|---|---|

| 2024 Rank | 2023 Rank | Contractor | 2024 | 2023 |

| 1 | 3 | T Clarke* | 678 | 425 |

| 2 | 1 | Dalkia | 609 | 607 |

| 3 | 2 | NG Bailey | 600 | 532 |

| 4 | 4 | SES Engineering Services | 464 | 299 |

| 5 | 7 | Crown House | 381 | 239 |

| 6 | 5 | SRW | 297 | 267 |

| 7 | 11 | Phoenix ME | 295 | 170 |

| 8 | 9 | Briggs & Forrester | 272 | 212 |

| 9 | 6 | Gratte Brothers | 262 | 250 |

| 10 | 10 | Dodd Group | 249 | 207 |

| 11 | 17 | Dornan Engineering | 222 | 79 |

| 12 | 8 | Vital Energi | 221 | 220 |

| 13 | 12 | Essex Services Group | 207 | 167 |

| 14 | 13 | HE Simm | 145 | 116 |

| 15 | 15 | JCA Engineering | 140 | 137 |

| 16 | – | Lorne Stewart | 122 | 150 |

| 17 | 18 | Borough Engineering | 116 | 78 |

| 18 | 14 | Ark Mechanical & Electrical | 113 | 112 |

| 19 | – | Gloster MEP | 112 | 79 |

| 20 | 26 | CMB Engineering | 110 | 72 |

| 21 | 19 | PIP | 94 | 68 |

| 22 | – | Halsion | 74 | 41 |

| 23 | 16 | Mace MEP | 74 | 82 |

| 24 | 24 | King & Moffatt UK | 73 | 58 |

| 25 | – | Dowds Group | 73 | 54 |

| 26 | – | Kane Group | 65 | 49 |

| 27 | – | Datalec Precision Installations | 65 | 35 |

| 28 | 23 | Stothers M&E | 62 | 59 |

| 29 | 21 | Designer Group | 61 | 62 |

| 30 | 30 | Swiftline Engineering | 61 | 55 |

* TClarke Contracting Ltd revenue is a pro rata estimate based on 15-month reported figure of £847m to 31 March 2025.

BESA’s chief executive officer David Frise said: “The overall mood is surprisingly buoyant.”

“Judging from the comments made in our report by company directors and senior business figures, the outlook is generally optimistic despite the considerable financial, technical and regulatory hurdles they are having to navigate.”

GHCS boss Gokhan Hassan, who compiled the sector performance, said: “The sector is not just resilient – it’s evolving. Firms are adapting supply chains and operating models to stay ahead of the disruption.”

Global uncertainties triggered by Donald Trump’s China tariffs and the collapse of ISG have failed to derail momentum in high-value engineering markets, said Hassan.

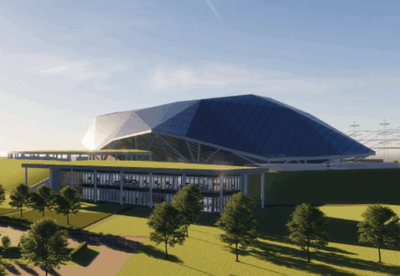

Instead, a new breed of M&E specialists is taking the lead on complex projects, with a few acting as principal contractors on schemes where services make up more than 60% of total build value.

Specialist firms are increasingly turning to recession-proof markets – including data centres, defence, life sciences and pharma.

Among the leading firms, T Clarke reported 15-month revenue of £847m to 31 March 2025, which when based on a pro rata 12-month figure jumped 60%.

This pushed EDF-owned Dalkia into second spot with a solid £609m turnover, while NG Bailey held firm in third, posting £600m — up 13% on last year.

Other big movers included Crown House, jumping from 7th to 5th with £381m, and Phoenix ME climbing from 11th to 7th after nearly doubling revenue to £295m.

Dornan Engineering made the biggest leap, rising six spots to 11th with turnover up 182% to £222m.

.gif)